Severe shortage of PMIC, to be rescued by 12-inch wafers?

More than a year has passed since the chip shortage, and the "long and short material" pattern has replaced the initial widespread shortage. Several "breakpoints" in the current supply chain are particularly noticeable, with PMIC being one of them.

From the IC trading network " Innovation Index " statistics, PMIC has been among the top five of the hot search list every month since last year. Only MCU has been able to keep it "suppressed" for a long time. This past week, PMIC remained among the top five, reflecting strong market demand.

[Innovation Index Weekly Category and Brand Hot Search Status]

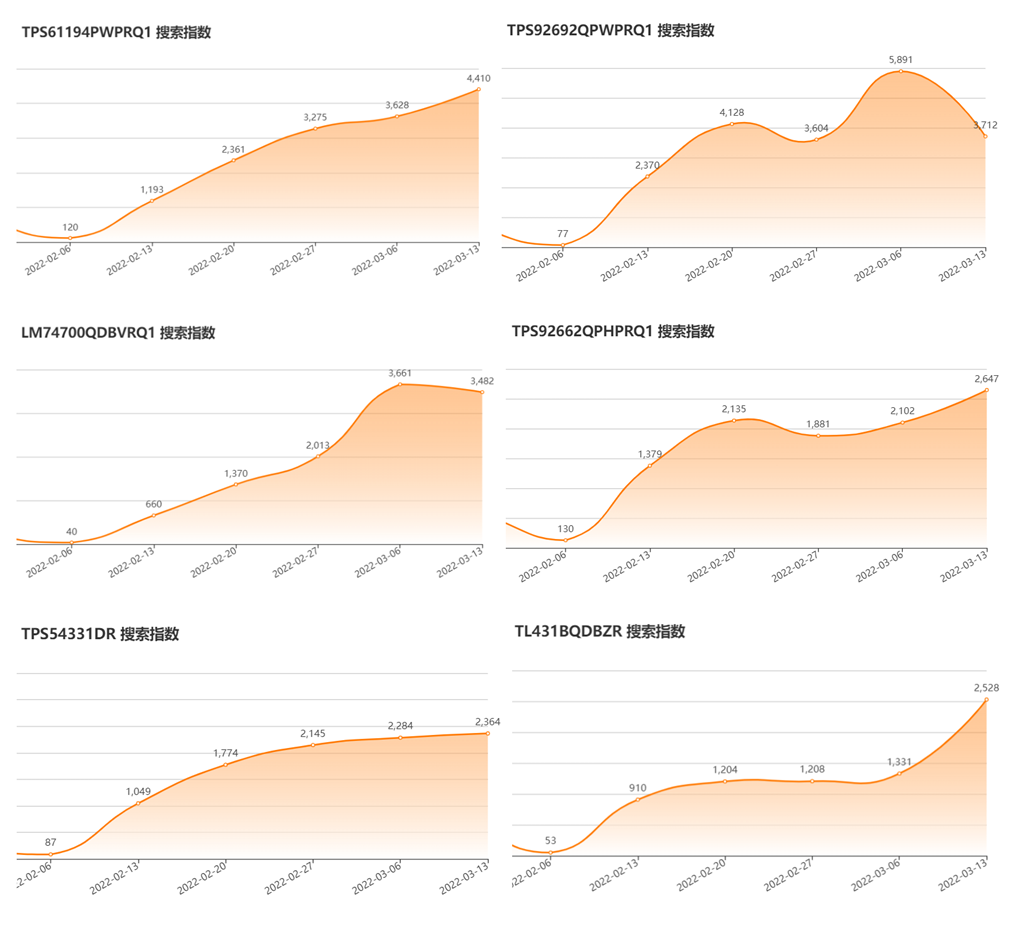

Among the various brands, TI's TPS92, TPS61, and LM series are the hottest in PMIC. It is precisely because of the huge search volume brought by PMIC that TI ranked first in brand hot searches last week, and for several consecutive weeks, surpassing all other brands, including ST.

[Innovation Index Weekly Search Volume of 6 TI Brand PMICs]

PMIC: It's used wherever there's power, and the demand is huge.

PMIC stands for Power Management IC. In a circuit system, the operating voltages of various chips and components are different. PMIC processes the fixed voltage provided by the battery or power supply through boosting, buck, and voltage regulation to meet the operating conditions of each component. If the main chip is the "brain" of the circuit system, then PMIC can be compared to the "heart" of the circuit system.

With the increasing popularity of electronic devices and the increasing electronization of industrial production lines and automobiles, the demand for PMIC is increasing day by day. Especially after the outbreak of the COVID-19 pandemic in 2020, online office work stimulated the demand for PCs and servers, and the new energy industry created by the environmental protection wave has brought the demand for PMIC to an unprecedented height in terms of both quantity and performance.

However, since the outbreak of the epidemic in 2020, several factors have led to difficulties in PMIC supply, and it remains one of the most severely out-of-stock materials. PMIC, along with MCU and panel control ICs, has become a "breakpoint" in the supply chain, affecting the delivery schedule of many electronic products.

[List of Major PMIC Manufacturers Source: CTIMES]

PMIC expansion is difficult, switching to 12-inch is key.

According to TrendForce's research, most PMICs are manufactured using 8-inch 0.18-0.11 micron processes. The shortage of 8-inch capacity was exposed even before the epidemic. Around 2016, new applications such as electric vehicles stimulated a large demand for "small chips," including PMIC, causing a shortage of 8-inch capacity that should have been replaced by 12-inch capacity. The chip shortage that erupted in 2020 exacerbated this structural shortage, leading to severe shortages and price increases for a series of small chips, including PMIC.

In the face of the huge supply-demand gap, many original manufacturers and chip foundries naturally need to expand production. However, in today's mainstream 12-inch wafers, the expansion of 8-inch capacity by various factories is generally insufficient. The supply of 8-inch equipment is in short supply, making the actual cost of expansion for chip factories not low. Furthermore, the mainstreaming of 12-inch wafers is unstoppable, and expanding 8-inch capacity at this time also incurs huge opportunity costs.

In the following years, the expansion of 8-inch wafers by chip factories will mainly increase a small amount of capacity by "debottlenecking." According to TrendForce's forecast, the compound annual growth rate of global top ten 8-inch equivalent wafer capacity from 2020 to 2025 is only 3.3%, compared to a 10% annual increase in 12-inch capacity. This shows that the focus of capacity expansion by various factories has long been on 12-inch wafers.

For small and medium-sized IC design companies, switching to 12-inch production lines is too costly, and the increase in unit capacity cannot compensate for the costs of re-development, verification, and taping out. Currently, large companies are the ones actively switching to 12-inch production lines.

TrendForce introduced that IC design companies such as MediaTek, Qualcomm, and Realtek are gradually transferring some PMICs to 12-inch 90/55nm process production. Among IDM manufacturers, TI and onsemi are the most active in switching to 12-inch. It is worth mentioning that PMIC is one of TI's "main battlefields." Therefore, in the view of IC trading network, TI's actions are most worthy of attention.

Large-scale IDM transformation to 12-inch, leading the rhythm.

As the leading player in the IDM field, TI has repeatedly changed the direction of the industry. TI is also quite proactive in this round of transition to 12-inch wafers.

Last July, TI acquired Micron's 12-inch wafer fab in Utah for only US$900 million. This fab was incorporated into TI, becoming its fourth 12-inch fab. Last November, TI announced that it will build up to four new 12-inch chip fabs in Sherman, Texas, with two starting construction this year. If all four wafer fabs are completed, the total investment will reach US$30 billion, and TI will have up to eight 12-inch wafer fabs, which is unmatched among IDM manufacturers.

TI's transformation to 12-inch is not a day's work, and it has already benefited greatly from it. As early as 2017, more than half of TI's analog revenue came from 12-inch production lines, enabling TI's overall gross profit margin to remain above 60% for many years. In contrast, the gross profit margin of other IDM manufacturers is generally between 40% and 60%. According to TI, 12-inch wafers can optimize the cost of unpackaged chips by 40% and reduce the cost of packaged chips by 20% compared to 8-inch wafers. This is obviously the secret to TI's significantly higher gross profit margin than other IDM manufacturers in recent years.

With TI's "trial" in the lead, more IDM manufacturers have also begun to deploy 12-inch production lines. In 2020, onsemi acquired a 12-inch fab from GlobalFoundries for as low as US$430 million, joining the "12-inch club." Before that, ST, Infineon, and other manufacturers also had their own 12-inch fabs, but the layout of these manufacturers is still far behind TI's.

The layout of 12-inch production lines by major IDM manufacturers led by TI is to produce PMIC and more "small chips" that were originally based on 8-inch wafers. TrendForce predicts that the mainstream products in the industry will switch to 12-inch production lines in the second half of 2023 to 2024, which should also be the time when the major chip shortage begins to subside.

Now that 2022 is almost a quarter over, the next period will be the "second half" of the chip shortage. The subsequent competition among chip manufacturers will revolve around the layout of 12-inch production lines. After TI's firm high position, who will be the next strong player? The IC trading network will look forward to it together with our industry friends.

Related Information

Kingbaco won the "High-Quality Brand Channel Agent" award